Payroll tax estimator

The system keeps you updated about the correct tax slabs so that no mistake is made. WPRO-11 Enter the date you will submit this W-4 Form to your employer or payroll department.

How To Calculate Payroll Taxes In 5 Steps

Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

. All foreign national employees any non US. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets. Login or register for an online account to access our wide range of services.

Tax Refund Estimator For 2021 Taxes in 2022. Withhold all applicable local state. 19 2014 requires the IRS to establish a voluntary certification program for professional employer organizations PEOs.

The payment plan estimator helps you work out how quickly you can pay off a tax debt and how much interest youll be charged. Use your estimate to change your tax withholding amount on Form W-4. Looking for a quick snapshot tax illustration and example of how to calculate your tax return.

For more details on how the Community Safety Payroll Tax will be administered see Administrative Orders 44-20-05-F applicable for tax. Student Business Services Payment Fee Information Paying the Bill Information. Determine your taxable income by deducting pre-tax contributions.

IRS Tax Withholding Estimator. Our Services Duties View more. It allows you to automate the process of directly depositing payments into the employees.

The longer you take to pay off your debt the more interest youll pay. If you would like to get a more accurate property tax estimation choose the county your property is located. The Community Safety Payroll Tax became effective January 1 2021.

This payroll tool is easy and helpful for small business owners. Time and Attendance System. Estimate your self-employment tax and eliminate any.

Congress passed several laws to stimulate the economy during the COVID-19 crisis. WPRO-12 In addition to your current IRS tax withholding which is most likely based on your latest W-4. Certain additional regulations apply for employees who are resident in New York City.

After You Use the Estimator. Online payroll for small business that is simple accurate and affordable. The tax is collected by the New York State Department of Taxation and Finance DTF.

H and R block Skip to content. Smart Payroll is a cloud-based payroll system that is quite popular in Australia. Estimate your tax refund with HR Blocks free income tax calculator.

Lodge your documents for a duties assessment. At tax time well provide W-2 940 and 941 information for you to populate and file. The Tax Increase Prevention Act of 2014 enacted Dec.

Or keep the same amount. Citizen on payroll must create and maintain a Glacier individual record. Employee Tax Withholding forms.

FAQs on the 2020 Form W-4. The APA its local chapters and others in the payroll industry use the week as a platform to spread awareness of the payroll withholding system to host community service projects and to educate others on how paychecks are calculated and how to get the most out of their pay. Employment verifications may be sent to the Payroll Office 878-4124.

People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 202223 tax refund. Our free salary paycheck calculator see below can help you and your employees.

Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. The tax usually shows up as a separate line on pay stubs. Skip To The.

Skip to main content. NYS IT-2104 Tax Withholding Form or Payroll Self Service NYS IT-2104E. Its helpful to have various free payroll estimator tools at your disposal.

IRS Tax Withholding Estimator. International Payroll and Taxes. Submit or give Form W-4 to.

This includes a payroll tax credit and other stimulus measures. Student Assistant Work Study Students Time and Attendance System. All 50 states and multi-state.

Payroll Payroll services and support to keep you compliant. Well tee you up for tax time. Upload an application for reassessment or refund of duty.

Taxes File taxes online Simple steps. PEOs handle various payroll administration and tax reporting responsibilities for their business clients and are typically paid a fee based on payroll costs. From 1 January 2023 the deduction range will increase which means a reduction in payroll tax for small and medium businesses.

The Eugene City Council passed the Community Safety Payroll Tax Ordinance No. They bring their 10 years of payroll expertise into this solution. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor you can use the free Illinois Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across Illinois.

Ask your employer if they use an automated system to submit Form W-4. 20616 to provide long-term funding for community safety services. Once youve worked out a suitable payment scenario based on your circumstances you can use it as a guide to set up a payment plan and address your tax obligations.

For annual Australian taxable wages over the 13 million threshold the deduction will change to 1 for every 7 of taxable wages over this amount. IRS Tax Withholding Estimator. To change your tax withholding amount.

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Federal Income Tax

How To Calculate Canadian Payroll Tax Deductions Guide Youtube

Federal Income Tax Fit Payroll Tax Calculation Youtube

How To Calculate Income Tax In Excel

Paycheck Calculator Take Home Pay Calculator

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

Payroll Tax Calculator For Employers Gusto

How To Calculate Federal Withholding Tax Youtube

How To Calculate Payroll Taxes Methods Examples More

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Paycheck Calculator Take Home Pay Calculator

Payroll Tax What It Is How To Calculate It Bench Accounting

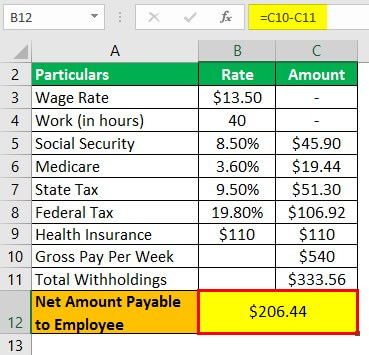

Payroll Formula Step By Step Calculation With Examples